I couldn’t make it to the Elephant Hills Resort for this year’s CEO Roundtable debate on de-dollarisation. Life and my other work commitments got in the way, which was a shame because there are few things I love more than watching grown adults argue politely about the fate of our money while surrounded by champagne and canapés.

Still, I caught the livestream, which, in true Zimbabwean fashion, buffered just enough to make me question both my Wi-Fi and the future of our economy. The topic was De-Dollarisation: A New Era or Dead End? A fitting question for a country that changes its currency policy more often than it changes ministers.

A Currency Support Group Disguised as a Panel Discussion

The panel was a cocktail of economic personalities: property mogul Ken Sharpe, the ever-smooth Nigel Chanakira, opposition MP Farai Mushoriwa, economist Prof. Gift Mugano, and Reserve Bank Deputy Governor Dr. Jesimen Chipika. Moderated by Trevor Ncube, it had all the ingredients of a national therapy session disguised as a policy conversation.

What followed was less a debate and more a group counselling session on trust issues between the government, the market, and the people. Everyone agreed that Zimbabwe needs a functioning currency. The disagreement, of course, was on how we get there or if we even can without breaking something else in the process.

Dr. Chipika, in her measured and technical way, explained why de-dollarisation is necessary for sovereignty and policy independence. It sounded noble enough, the kind of thing you’d hear at a graduation ceremony or in a particularly optimistic budget speech. But every time she mentioned “sovereignty,” I couldn’t help but think of the local tuckshop guy who insists on being paid in crisp US notes and wonders which planet the central bank lives on.

The Idealists, the Realists, and the Real-Problemists

Nigel Chanakira brought his trademark optimism, arguing that a country cannot thrive without its own currency. To him, de-dollarisation is not a punishment, it’s a journey toward national dignity. He spoke like a man who believes in Zimbabwe’s potential and in fairness, he always has.

Farai Mushoriwa, on the other hand, was less romantic. He reminded everyone that without genuine fiscal discipline, any talk of de-dollarisation is just economic cosplay. You can’t preach sovereignty while spending recklessly, and you can’t demand trust while rewriting the rules every few months. It was the kind of grounded logic that makes economists nod and politicians shift in their seats.

Prof. Gift Mugano, never one to sugarcoat things, argued that de-dollarisation isn’t just an economic decision; it’s a political gamble. He pointed out that people don’t lose faith in currencies they lose faith in governments. He has a point. Zimbabweans don’t need another lecture about patriotism; they need proof that the same people managing the money can resist the temptation to abuse it.

Then there was Ken Sharpe, who gave the business perspective, which is to say: let’s be practical. Businesses, after all, deal in reality, not rhetoric. They price in USD because it’s stable, predictable, and universally trusted. You can’t ask the private sector to believe in a system that keeps shifting under their feet. If de-dollarisation is to work, it needs predictability, not patriotic slogans.

The Israel Case Study: How to Tame a Currency Without Losing Your Mind

Someone on the panel (should be Ken I think) referenced Israel’s economic turnaround in the 1980s the textbook case of how to discipline a runaway currency. The Israeli government didn’t solve hyperinflation by praying or printing prettier money. They reined in spending, stabilized expectations, and built trust through credible, consistent policy. Inflation fell, faith returned, and the shekel found its footing.

The key word here is credibility. Israel earned it. We, on the other hand, keep trying to buy it on credit. And each time, the market reminds us that trust is not for sale at the Reserve Bank.

I found myself nodding along. Having our own currency makes sense in theory national pride, monetary sovereignty, policy control, all of that sounds great. But without fiscal discipline and clear communication, it’s just another paper promise. The current multi-currency system may not inspire poetry, but at least it works, sort of. It’s the messy roommate who pays rent late but always pays in cash.

De-Dollarisation: A Faith-Based Initiative

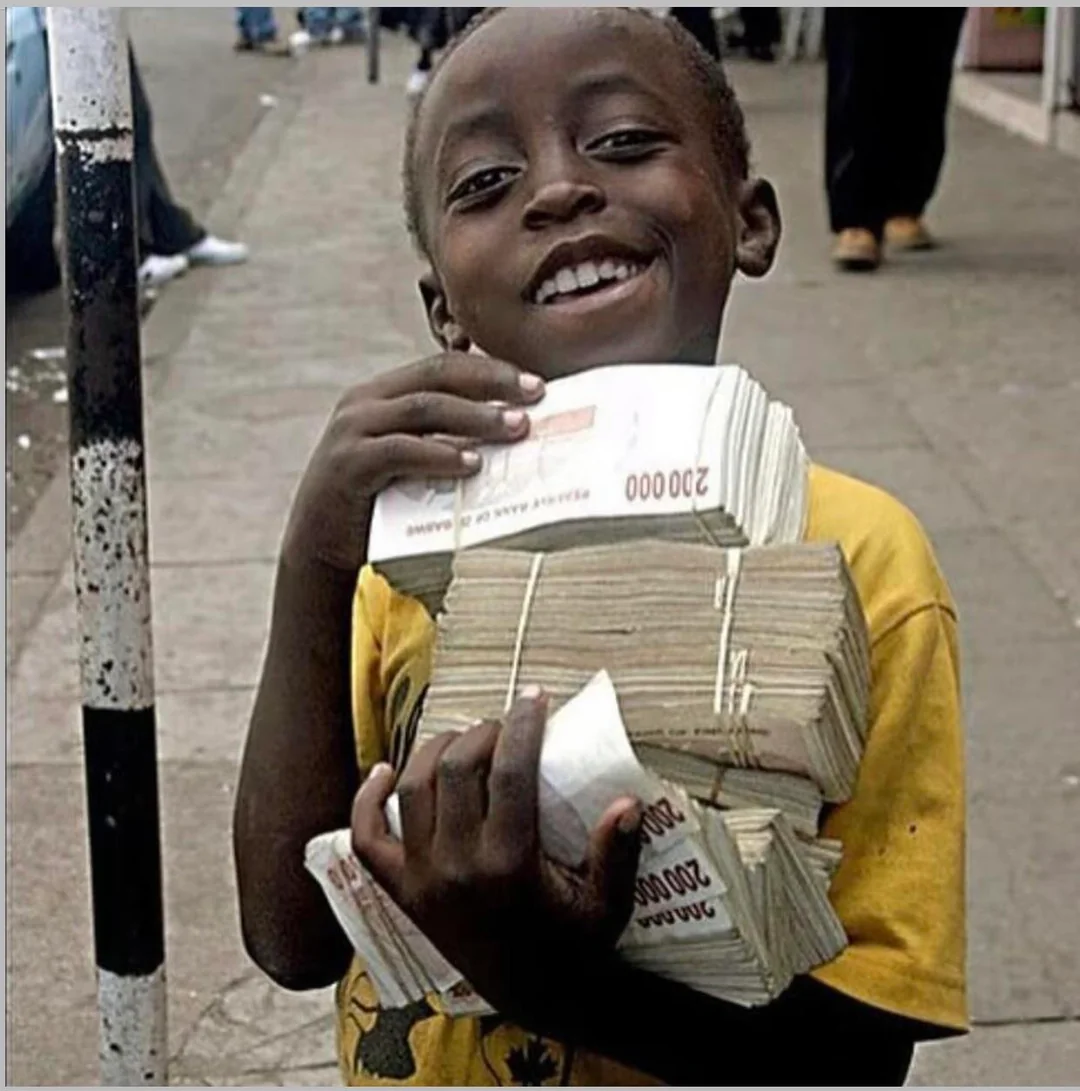

The truth is that Zimbabwe’s currency problem isn’t about economics anymore. It’s about psychology. After years of inflation, redenomination, and wallet trauma, people simply don’t believe in the local note. It could be gold-backed, God-blessed, or glow in the dark and still, the market would rather hold USD.

We’ve become experts in self-preservation. We no longer save; we hedge. We no longer trust announcements; we wait for proof. It’s not cynicism. It’s survival instinct.

Watching that debate, it struck me that what Zimbabwe needs isn’t another new currency. What we need is a new relationship between citizens and state, between policy and practice, between promises and proof. Until that happens, de-dollarisation will remain a beautiful theory, trapped in the wrong reality.

Conclusion: Of Notes and Notions

So, where do I stand? Somewhere between hopeful and exhausted. I want Zimbabwe to have a strong, trusted national currency again. But I also think rushing into it without repairing our credibility is like repainting a house with a cracked foundation. It might look better, but it won’t hold.

The current mixed-currency system may not be elegant, but it’s keeping the lights on. Let’s build trust first. Let’s prove to the world and ourselves that we can manage our money responsibly. Then, maybe, we’ll have earned the right to print our own notes again.

Until then, I’ll keep watching these debates online, wondering if we’ll ever find a balance between economic theory and the price of bread.